Indemnities – Useful or unfair?

By Lara Keil (Candidate Legal Practitioner) under the guidance of Tzvi Brivik (Director)

On 16 August 2022, Alyssa Conley, a former South African Olympian was in the Seychelles getting ready to compete in the first beach challenge of the Tropika Island: All Stars Series.

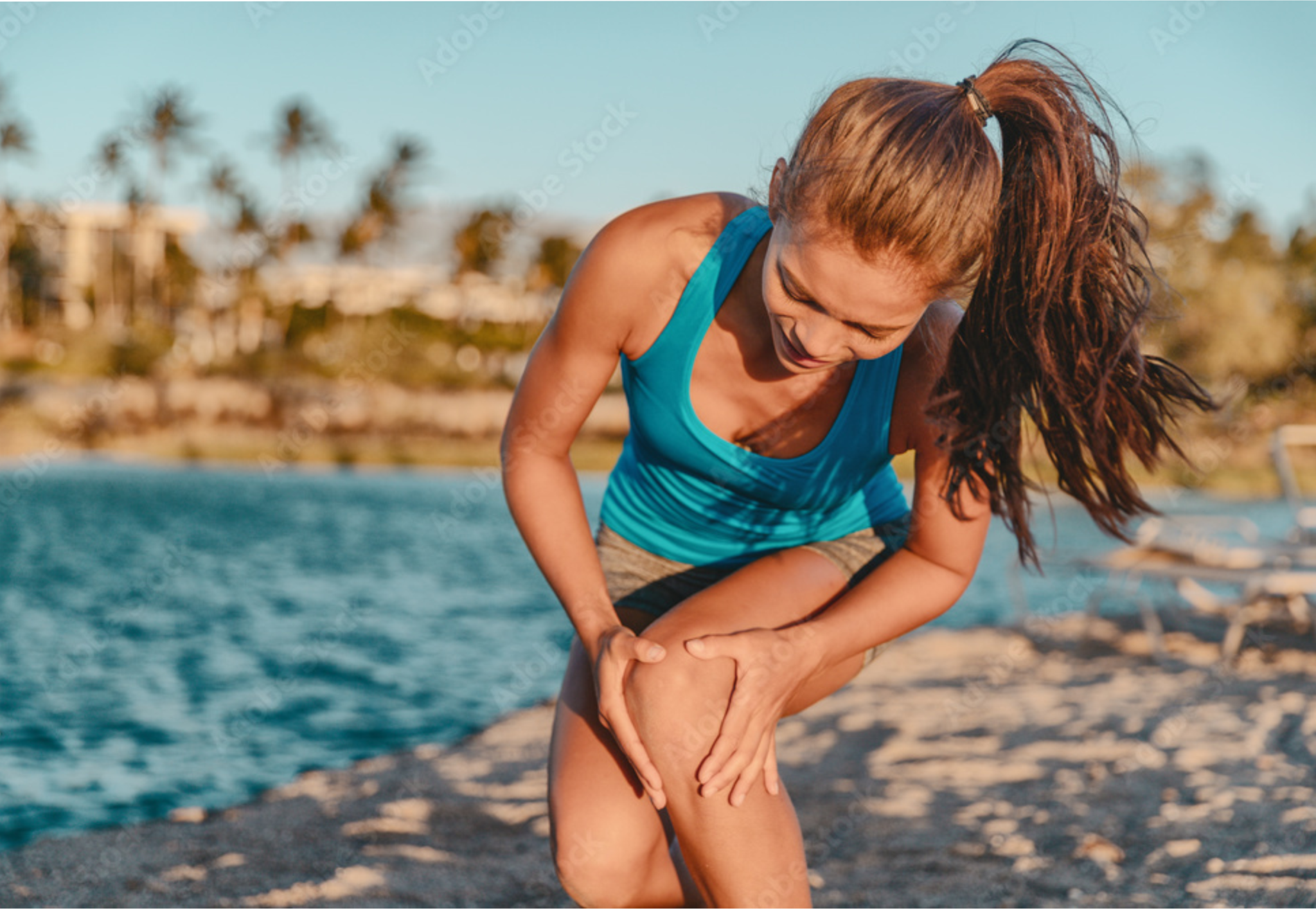

The Challenge commenced and contestants were required to make their way into the ocean. Being a sprinter, Alyssa ran full speed into the ocean and her foot became stuck in the sand, resulting in the dislocation of her knee and the tearing of her patella tendon. The concern? Alyssa signed an agreement including an indemnity clause.

Understanding Indemnities

To better understand indemnities, it is vital to have considered what an indemnity agreement is and the law which regulates it. An indemnity agreement is a contractual undertaking not to institute action against a wrongdoer for damage caused by him or her.

Although a vast number of these indemnity agreements are regulated by the Consumer Protection Act (hereafter referred to as the “CPA”), contractual indemnity agreements are still also regulated by common law, which if placed in dispute must be considered by the courts.

In terms of the CPA, a consumer may not be required to waive any liability of the supplier on terms which are unfair, unreasonable or unjust.

The CPA further provides that terms or conditions are unreasonable or unjust if:

- These are excessively one-sided in favour of any person other than the consumer; or

- The terms are so adverse to the consumer as to be inequitable

Moreover, section 49(2) of the CPA provides that if a provision concerns any activity or facility that is subject to any risk of an unusual character or nature which the consumer or an ordinarily alert consumer could not reasonably be expected to notice or contemplate in the circumstances or which could result in death, then the supplier must specifically draw the fact, nature and potential effect of that risk to the attention of the consumer.

Where the CPA is not applicable, courts are required to interpret the common law and consider one party’s right to freedom of contract against public policy considerations.

In the case of Beaduca 23 CC and Others v Trustees for the time being of Oregan Trust and Others 2020 (5) SA 247 (CC), the Constitutional Court stated the determinative test is whether such a contractual term is so unfair, unreasonable and unjust that it would be considered contrary to public policy.

The enquiry to determine whether a clause is contrary to public policy is two-fold, with the first stage considering the clause itself. The court must consider whether the clause is so prima facie unreasonable as to be contrary to public policy.

Should the court be of the opinion that in fact, it is, the clause will be struck down. However, should the clause be found to be reasonable, then the second stage requires the court to consider whether given the circumstances of the case, it would be contrary to public policy to enforce the clause. The onus to demonstrate why its enforcement would be unfair and unreasonable rests on the party seeking to avoid such enforcement.

What becomes increasingly clear from both legislation and case law, is that contrary to popular opinion, the mere existence of an indemnity agreement does not automatically absolve parties from any and all liability.

Should you require any assistance in handling matters involving indemnities or defective products, contact the team at Malcolm Lyons & Brivik Inc. for assistance.

Lara Keil (Author) under the guidance of Tzvi Brivik (Director)

Candidate Attorney at Malcolm Lyons & Brivik Inc.

LLM Candidate: Labour Law (UWC)

Malcolm Lyons and Brivik Attorneys are leading experts in the field of labour law, medical negligence and accident law in South Africa. To discuss whether you have a case, contact our offices below:

Telephone:

Cape Town Office:

Telephone: +27(0) 21 425-5570

E-mail: [email protected]

Johannesburg Office:

Telephone: +27(0) 11 268 6697

Email: [email protected]

Contact form: